welcome to this presentation of the health insurance marketplace 101. it provides a high-level overview of the affordable care act and the new health insurance marketplace. the centers for medicare & medicaid services (cms) developed and approved this training module. cms is the federal agency that administers medicare, medicaid, the childrens health insurance program (also known as chip), and the health insurance marketplace. this presentation was up-to-date in november of 2013. congress passed, and the president signed the affordable care act in march of 2010. this now allows most young adults who cant get health

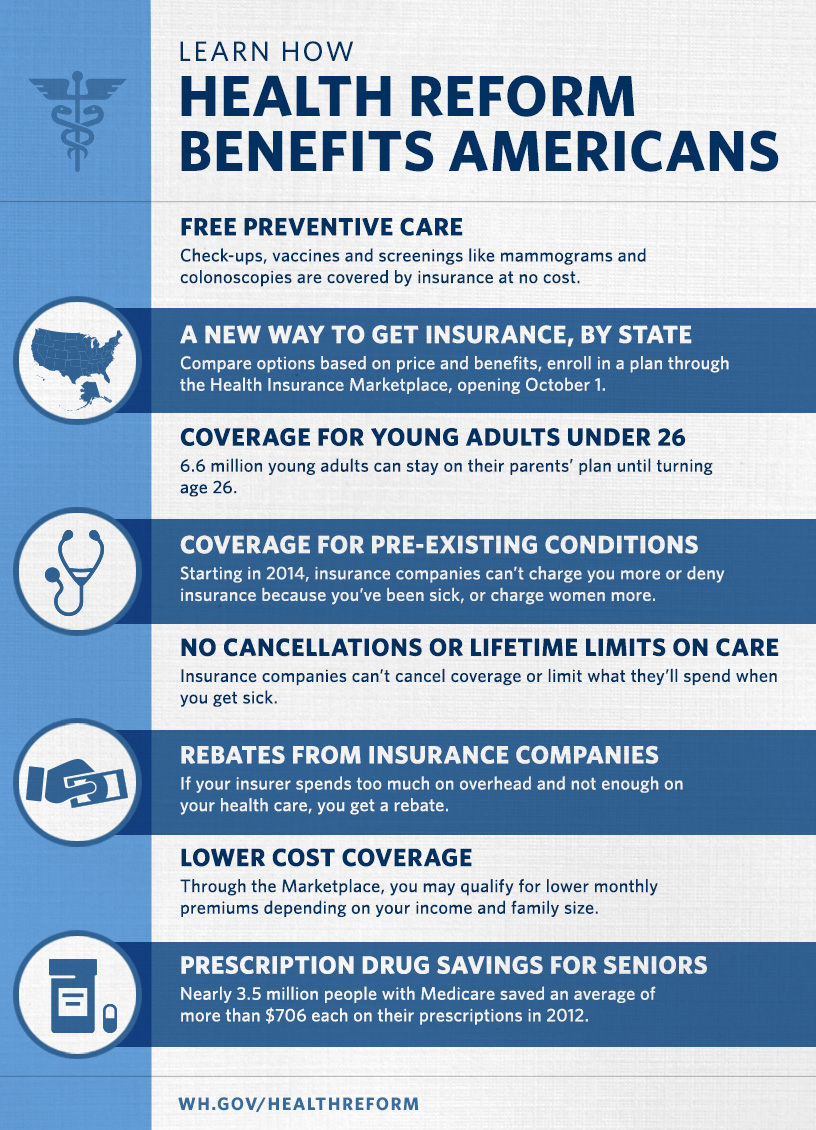

coverage through their jobs, to stay on their parents plans until age 26. also, the 50 million americans with medicare have access to new benefits like free preventive care, and savings on prescription drugs when they hit the coverage gap, also known as the donut hole. about 71 million people with private insurance can also get recommended preventive care without paying any copay or deductible. the law also removed lifetime limits on coverage of essential health benefits. the affordable care act has additional improvements to health care that start on january 1st of 2014. beginning in 2014, discrimination due to

pre-existing conditions or gender is prohibited, annual limits on insurance coverage are eliminated, advanced premium tax credits are available, the small business tax credit increases, and in some states, more people are eligible for medicaid. also, coverage through the health insurance marketplace begins as early as january 1st of 2014 for consumers who enrolled in a plan by the deadline and paid their first monthly premium. now, lets take a closer look at the health insurance marketplace. the health insurance marketplace is designed to help you find health

insurance that fits your needs and budget. every health insurance plan in the marketplace offers comprehensive coverage, from doctors to medications to hospital visits. you can compare all your insurance options based on price, benefits, quality, and other features that may be important to you, in plain language that makes sense. the marketplace is sometimes referred to as exchanges or obamacare. theres a marketplace for small business too. its called the small business health options program, or shop. well briefly talk about shop later, but this session focuses on the individual marketplace.

the marketplace is a way to shop for health coverage. youll be able to make an apples-to-apples comparison of the plans in your area. about 90% of the people who currently dont have insurance will qualify to get a break on their costs. this includes coverage by medicaid, the childrens health insurance program (or chip), and cost savings in the marketplace. thanks to new rules and expanded programs, even working families are able to get help through the health insurance marketplace. even if you think your income might be too high to get help, you should apply to see which programs you may qualify for.

each state has flexibility in establishing a marketplace that meets the needs of its residents. states across the country received grantsto establish marketplaces. some states are operating their own marketplace. the federal government is operating a marketplace in those states that didnt establish their own, and these states can choose to partner with the federal government. a partnership marketplace allows states to make recommendations for key decisions and help tailor a marketplace to local needs and market conditions. a state may apply at any time to run its own marketplace in future

years. states may also choose to run a small business health options program (or shop) marketplace. u.s. territories can decide whether to create their own marketplace or expand medicaid coverage. residents of a u.s. territory arent eligible to apply for health insurance using the federal or state marketplace. the health care law requires all plans to cover essential health benefits in at least the following 10 general categories: ambulatory patient services (outpatient care you get without being admitted to a hospital) emergency services hospitalization (such as surgery)

maternity and newborn care (care before and after your baby is born) mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy) prescription drugs rehabilitative and habilitative services and devices (these are services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills) laboratory services preventive and wellness services and chronic disease management and pediatric services, including oral and vision care (pediatric oral services may be provided by a stand-alone

plan). qualified health plans in the marketplace can vary. for instance, some plans may cover additional benefits. you may have to see certain providers or use certain hospitals. the premiums, copays, and coinsurance are different in different plans. the quality of care can vary, but quality data are available for you to compare. the coverage level can also vary within each plan as youll see on the next slide. there are also some plans that are structured differently, like high-deductible (catastrophic) plans. but remember, all plans must

cover the 10 categories of essential health benefits. the health care law requires that plans meet certain levels of coverage. each of these levels of coverage is associated with an actuarial value, which is calculated based on providing the essential health benefits to a standard population. these levels can be considered a general measure of health plan generosity. for example, if a plan has an actuarial value of 70%, on average, you would be responsible for 30% of the costs of all covered benefits. however, you could be responsible for a higher or lower percentage of the total costs of covered services for the year,

depending on your actual health care needs and the terms of your insurance policy. the levels of coverage are as follows: * a bronze level plan has an actuarial value (or av) of 60%. * a silver level plan has an av of 70%. * a gold level plan has an av of 80%. * and a platinum level plan has an av of 90%. while premiums are not taken into account to calculate the actuarial value, generally plans with a higher actuarial value and more generous cost-sharing tend to have higher premiums. a catastrophic plan is a different type of plan thats available to only

certain people. it generally requires you to pay all of your medical costs up to a certain amount, usually several thousand dollars. costs for essential health benefits over that amount are generally paid by the insurance company. catastrophic plans generally have lower premiums and protect against high out-of-pocket costs.they also cover three annual primary care visits and preventive services at no cost. catastrophic plans are available only to people under the age of 30, and to people who have received certain hardship exemptions. each member of a family must meet these eligibility requirements to purchase a catastrophic

plan. people with catastrophic plans are not eligible for premium tax credits to lower their monthly premiums. you may qualify for a hardship exemption if certain circumstances affect your ability to purchase health insurance coverage, like being homeless; being evicted in the past 6 months or if you were facing eviction or foreclosure; or if you filed for bankruptcy in the last 6 months. small businesses have access to a streamlined way to offer health insurance to their employees for 2014 and future years. its called the

small business health options program, or the shop marketplace. its open to employers with 50 or fewer employees in 2014. in 2016, the program will be open to businesses with 100 or fewer employees in all states, and a few states could choose to expand eligibility to such businesses before then. the shop marketplace is part of the health insurance marketplace. it gives small businesses and their employees access to qualified health plans that must include a package of essential health benefits, like coverage for doctor visits, preventive care, hospitalization, and prescriptions. small businessesincluding

non profit and religious organizationscan participate in the shop marketplace. for those who complete the enrollment process by the deadline, coverage can take effect as early as january 1st of 2014. small employers will also be able to enroll and offer coverage to their employees any time after january 1, 2014. theres no requirement under the new health care law for small businesses with fewer than 50 employees to offer health insurance, nor is there any fee for those small employers who dont offer employee health insurance. instead, the law offers small employers a range of new

options, tools, and protections, and for many, tax credits, to help those who would like to, or already offer, employee health coverage. employers can get shop and small business questions answered by a customer service representative at 1-800-706-7893 (tty users should call 1-800-706-7915). the shop call center is open monday through friday, 9 a.m. to 7 p.m. eastern time. to be eligible to enroll in a marketplace plan, you must live in its service area. you must also be a u.s. citizen or national, or be a non-citizen who is lawfully present in the u.s. for the entire period

for which enrollment is sought. you also cannot be incarcerated, unless youre pending disposition of charges. however, even if youre incarcerated, you can apply for medicaid or chip at any time. when you use the marketplace you may be able to get lower costs on your monthly premiums through a premium tax credit. this tax credit is generally available to individuals and families with incomes between 100% and 400% of the federal poverty level (which is $23,550 to $94,200 for a family of four in 2013), if they dont have access to certain other types of minimum essential coverage. well talk about minimum

essential coverage later. the advanced premium tax credit available through the marketplace lets you reduce your premiums right away or you can wait to receive the premium tax credit at tax time. this chart illustrates the three ways you can choose to take your premium tax credit. you can use it all immediately, use part of it, or wait to use it until tax time. if you use it all up front, you lower your monthly premium the most. you would most likely not get money back as a credit when you file your federal tax return. if your circumstances, like income or family size change, you should notify the

marketplace. otherwise, you may likely have to pay money back when you file your taxes. if you use part of the premium tax credit you qualify for, your monthly premium will be lower. you may get some money back as a credit on your federal tax return. if your circumstances, like income or family size change, and you dont notify the marketplace, you may have to pay money back when you file your taxes. finally, if you choose not to use any of your tax credit to lower your premium, you would pay the full premium each month. however, you would get money back as a credit on your federal tax return. you wouldnt have

to pay any money back; however, you should still notify the marketplace of any changes. you should report to the marketplace any changes in financial circumstances or family size immediately, including changes in household income, marriage, divorce, birth or adoption of a child, other changes to household composition, or gaining or losing eligibility for government or employer sponsored health coverage. check the information on your application or you may not get the right amount of savings. if you earn more income than the qualifying household income amount, the

amount of savings for which youre eligible is lower when you file your tax return. in this case, you might owe money at the end of the year. if you make less than you expected, you may be eligible to receive a refund based on a higher premium tax credit at the end of the year. you would do this on your next tax return. if you think a mistake was made when you get your savings decision determination in the marketplace, you have the right to appeal. the marketplace eligibility determination will explain how to do this. cost-sharing reductions are also available to help reduce out-of-pocket

expenses, such as deductibles, coinsurance, and copayments. to be eligible for cost-sharing reductions, you must have a household income that is less than or equal to 250% of the federal poverty level (which is $58,875 annually for a family of four in 2013). you must also meet the requirements to enroll in a health plan through the marketplace, receive the new tax credit, and enroll in a silver-level plan through the marketplace. members of federally-recognized indian tribes may also be eligible for special cost-sharing reductions. certain american indians and alaska natives who purchase health insurance through the

marketplace dont have to pay co-pays or other cost sharing if their income is under 300% of the federal poverty level, which is roughly $70,650 for a family of four in 2013 (or $88,320 in alaska). beginning in januaryof 2014, individuals under 65with incomes up to 133% of the federal poverty level (fpl) are eligible for medicaid in those states that expand their medicaid programs. in addition, all children with incomes up to 133% of the federal poverty level are eligible for medicaid. the rules for counting income for purposes of determining medicaid and chip eligibility are much simpler and easier to understand.

starting in 2014, everyone must either have minimum essential health coverage, have a coverage exemption, or pay a fee (which is also called the shared responsibility payment). if you have minimum essential coverage, you dont have to do anything. youre already covered. if you qualify for an exemption, you wont have to pay the fee even if you dont have health coverage. but, if you dont have coverage, and dont qualify for an exemption, you have to pay a fee. lets look at what all this means. minimum essential coverage is coverage that meets a standard that

provides essential health benefits. if you have any of these types of coverage, you have minimum essential coverage and dont have to do anything. about 85% of americans have minimum essential coverage, which includes but isnt limited to employer-sponsored coverage, including cobra and retiree coverage, medicare, medicaid, childrens health insurance program (also known as chip), marketplace coverage, individual coverage (purchased outside the marketplace), and tricare or certain types of va coverage. minimum essential coverage doesnt include coverage providing only

limited benefits, such as coverage only for vision care or dental care, workers compensation, disability policies, and medicaid covering only certain limited benefits such as family planning. if you dont have minimum essential coverage, you may have to pay a fee. well discuss that next. you may get an exemption from the fee for one of these reasons: religious conscience; membership in a recognized health care sharing ministry; membership in a federally recognized indian tribe; if you have no tax filing requirement (meaning your household income is below the minimum tax filing threshold); if you have

a short coverage gap of less than 3 consecutive months; if you suffered a hardship (a circumstance that affects your ability to purchase health insurance coverage, like being homeless, or if you recently experiencing domestic violence); if you have unaffordable coverage options (meaning the minimum amount you must pay for premiums is more than 8% of your household income), if youre incarcerated; or if youre not lawfully present (neither a u.s. citizen, a u.s. national, nor an alien lawfully present in the u.s.). when an uninsured person requires urgentoften expensivemedical care, but doesnt pay the bill, everyone else ends up

paying the price. thats why the health care law requires all people who can afford it to take responsibility for their own health insurance by getting coverage or paying a fee (also known as a shared responsibility payment). people who choose not to obtain health coverage will also have to pay the entire cost of all their medical care. less than two percent of americans are expected to choose to go without coverage and will owe the fee. if you sign up for marketplace coverage by march 31st of 2014, you wont have to pay a fee for a gap in coverage for 2014.

this table shows how the fee will be calculated starting in 2014 and beyond. you pay the fee when you file your 2014 federal income tax return in 2015, and thereafter. the fee in 2014 is $95 per adult and $47.50 per child (up to $285 for a family), or 1.0% of yearly income, whichever is greater. the fee cannot be more than the national average price for a bronze-level plan in the marketplace. amounts go up after 2014. its important to remember that someone who pays the fee wont get any health insurance coverage.

if youre eligible for marketplace coverage, you can enroll only at certain times. the first enrollment opportunity is the initial open enrollment period which runs from october 1st of 2013 through march 31st of 2014. there will also be an annual open enrollment period each year. beginning in 2014 and beyond, the annual open enrollment period begins october 15 and extends through december 7. any plan changes take effect on january 1st of the following year. you may qualify for a special enrollment period that could allow you to

enroll at other times due to certain circumstances. for instance, if you or your dependent loses minimum essential coverage; or if you gain a dependent or become a dependent through marriage, birth, adoption or placement for adoption; or if you werent previously a citizen, national, or lawfully present individual but your status changes and you now qualify for marketplace coverage, youll be able to enroll. there are other special circumstances that could make you eligible for a special enrollment period too. youll have 60 days from the date of the event to enroll during a special enrollment period.

you can apply for medicaid and the childrens health insurance program (chip) at any time. there are four steps to using the marketplace. first, you create an account. you provide some basic information, and choose a user name, password, and security questions for added protection. next, you apply by entering information about you and your family, including your income, household size, other coverage youre eligible for, and more. visit healthcare.gov to get a checklist to help you gather the information youll need.

then, you pick a plan. youll see the plans and programs youre eligible for and compare them side-by-side. youll also find out if you can get lower costs on monthly premiums and out-of-pocket costs. the last step is to choose a plan that meets your needs and enroll. coverage starts as soon as january 1st of 2014. if you have any questions, theres plenty of live and online help along the way. there are four ways to get marketplace coverage - by phone, online, in person, or by mail.

the number for the national health insurance marketplace call center is 1-800-318-2596. tty users should call 1-855-889-4325. customer service representatives are available 24 hours a day, 7 days a week, including new year's day. the call center is closed on thanksgiving, christmas, labor day, memorial day, and the fourth of july. the call center provides objective information in english and in spanish. it uses language lines for 150 additional languages. the customer service representatives can help you go through the eligibility and enrollment process, and can refer you to local in-person help.

on the previous slide we talked about the process for enrolling using healthcare.gov. the website is also available in spanish at cuidadodesalud.gov. these websites are accessible for those with visual disabilities. if your state is running its own marketplace (state-based marketplace), youll be referred to its website. if you go to healthcare.gov and click on preview plans and prices you can see what plans are available in your area and their full cost. if you qualify for a tax credit or cost sharing reduction, you would save on these costs.

the paper application is available for download and printing on healthcare.gov. in-person help is also available. lets look at some of your local help options. no matter what state you live in, youll be able to get live in-person help as you go through the process of applying for and choosing new coverage options in the marketplace. there are several programs that provide local in-person help with the process of enrolling and using health insurance, including the navigator program, non-navigator

assistance personnel, agents and brokers, and certified application counselors. to find assistance in your area, go to localhelp.healthcare.gov. its important to note that some of the assistance resources like the marketplace call centers and websites, and navigators, are required to provide unbiased and impartial advice, while others (such as some agents and brokers and issuer web sites and call centers) are not. organizations that dont meet the requirement to become certified assisters are invited to become champions for coverage. they can help

educate the public about the marketplace and refer them to resources where they can find assistance. visit marketplace.cms.gov for more information. if you have medicare, cobra, or belong to a pre-existing condition insurance plan, theres some information we want you to know. medicare isnt part of the health insurance marketplace. it provides minimum essential coverage. if you have medicare, you dont have to do anything. the marketplace doesnt change your medicare plan choices or your benefits. medicare plans and supplement policies (sometimes called

medigap plans), arent available in the marketplace. the medicare annual open enrollment period is from october 15th through december 7th of each year. if you turn 65 in 2014, you can get a marketplace plan to cover you before your medicare begins. you can then coordinate cancelling your marketplace plan when your medicare coverage starts to avoid a gap in coverage. if you enroll in medicare after your initial enrollment period ends, you may have to pay a late enrollment penalty for as long as you have medicare. now lets look at cobra. when you leave a job, you may be able to keep

your job-based health coverage for usually up to 18 months. this is called cobra continuation coverage. you can drop cobra coverage during marketplace open enrollment (october 1st of 2013 through march 31st of 2014) and get a marketplace plan. its important not to let your cobra coverage end before your marketplace coverage begins to avoid a gap in coverage. if your cobra expires, you get a special enrollment period and can enroll in a marketplace plan within 60 days. the health care law established the pre-existing condition insurance plan (pcip) program in every state and the district of columbia. there

are about 110,000 people currently in pcip nationwide. pcip provides temporary coverage to people with pre-existing conditions. this program ends december 31st of 2013. if youre enrolled in a pcip, and want to ensure no break in coverage by enrolling in the marketplace, you must enroll by the deadline. the pcips sent notices to their enrollees to make them aware and encourage them to take action. enrollment in the marketplace began october 1st of 2013. some pcip enrollees may be eligible for medicaid or other sources of coverage. lets go over some key points to remember: the marketplace is a new way

to find and buy health insurance. individuals and small businesses can shop for health insurance that fits their budget. states have flexibility to establish their own marketplace. individuals and families may be eligible for lower costs on their monthly premiums and out-of-pocket costs. and, there is assistance available to help you get the best coverage for your needs. you can get up-to-date information to help you counsel people who may

benefit from the health insurance marketplace at marketplace.cms.gov. you can access consumer materials, training materials (including videos), research and more. you can sign up for email updates as well. this is also where organizations can apply to become certified application counselors and champions for coverage. do you need more information about the health insurance marketplace? you can sign up to get email and text alerts at healthcare.gov/subscribe (cuidadodesalud.gov provides the healthcare.gov information in spanish). updates and resources for partner organizations are available at

marketplace.cms.gov. and if you use social media, you can like us on facebook and follow us on twitter! this completes this introductory presentation on the health insurance marketplace. thank you for your participation.

No comments:

Post a Comment